Changing the Landscape.

Monday, April 18th, 2016If there’s one proptech company that we can see changing our industry in the next few years, it’s recent PiLabs investees Land Insight. We were lucky enough to get an hour of founder and CEO Johnny Britton’s time and chat about startup life, accusations that they’re taking away competitive advantage and how he plans to solve the housing crisis. Keep an eye on these guys. They might just change everything.

For those that don’t know, can you give a quick overview of Land Insight, what it is and what it does?

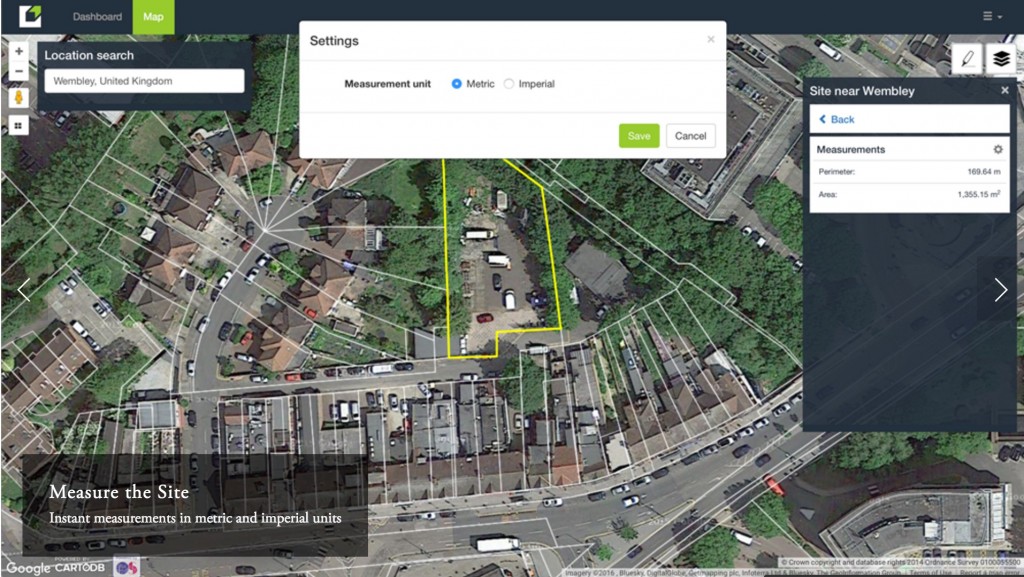

Land Insight is a web app that helps property developers and agents find and assess off-market development land. It brings together the core data sets and maps that are needed to spot new opportunities and make viability assessments, as well as a providing a number of tools to speed up your workflow.

So what are the benefits for property developers?

Our angle on things is that we provide all the data and you can access that as much as you like. Because we don’t charge for data, we can do additional things with it, such as visualise it, cross-reference it and filter out parameters so you only see things that are interesting to you. This means you can locate sites that fit your requirements faster than ever.

So say you are a developer for example and you need to locate big development sites, you can filter straight through to find larger sites that are relevant to you.

Exactly. Your particular model might be add value to failed planning applications, so you could therefore specify that you’re looking for a site of 30,000 ft.² that has been used for office space and had failed planning applications on them. Our data can be used to streamline the process of easily locating these sites so you don’t have to go walking the streets or spend time making a lot of calls trying to put it together one way or another. Overall it’s a huge efficiency saving.

Where did the idea for Land Insight come from?

My co-founder had an interest in self-building. He tried to find a website to help him locate land and there were none of any use. Following this experience he started thinking about how he could help other people find land. My background is in town planning. I was putting in an application for 100 new homes and I was being charged out at quite a lot of money. I knew that someone down the chain was making very good money but had no idea where they were getting their land from. It seemed like a murky world and we knew there was no good data out there. After leaving town planning to become a software entrepreneur with some nice ventures under my belt, I happened to be at the right time at the right place to be introduced to my cofounder, Andrew.

We didn’t know exactly what software we were going to build at first but we just knew that there was a problem with the market. There’s a housing crisis, lots of houses need to be built and all the property developers are saying that they can’t find land. We felt this problem needed to be solved.

We used the Silicon Valley methodology of the lean start-up and it worked. We spoke to the industry to test the validity of products and ideas in the market, pitching ideas to developers and asking whether they’d buy them. We waited until their response was positive and they were really interested in buying what we had before we went off and built it.

So why do you think this problem hadn’t been solved by technology previously?

I don’t think that it would’ve been possible to do it before now. For example the dataset we use to provide free ownership information has only recently been made available by Land Registry. And Ordnance Survey data can only now be used in more innovative ways. The U.K. is currently experiencing a severe housing crisis and so the political will is there more than ever to support startups. Additionally, and perhaps most importantly, we’ve got fast, cheap access to big servers where we can process millions of different data points and serve them up through mobile phones and devices – that’s not been possible before. It was a case of right place, right time, really.

I’ve seen on your literature that 9 out of 10 people looking to self-build cant find the land. So Land Insight is obviously going to be of huge value to them. But what about people involved in selling commercial property – the surveyors and agents? What are the major benefits for them?

We save them huge amounts of time. For a start, if it’s a larger site, they save money using us as we bulk purchase Land Registry ownership details, so we can provide them for free to our users – helping them show the context of where a site is sitting. With the addition of planning applications, they can predict how the area will develop, And then we’ve got all the other data sets like the commercial valuations, height data, whether there’s a flood risk, if it’s a listed building etc. So there’s a real streamlining effect.

There’s another good statistic that I hear all the time – when trying to find a new site for yourself or a client, only 1 in 100 letters that get sent have any response. So you don’t want to be assessing 100 sites at 3 hours a site. That would take weeks. But if you can get rule out many sites and contact only high quality sites in 15 minutes, and use our workflow tools to easily start making contact with landowners. Surveyors can suddenly be much more proactive in finding sites.

People must have been biting your hand off when you released the first beta?

We’ve had over 600 signups but it came with a bit of hesitation as well. One thing I hear all the time is that people say we’re giving away their competitive edge. But the thing is, the data is becoming available and it’s not going away – digital data is here to stay and we have just seen the opportunity.

Ultimately, people will still have their contacts and their local knowledge, and we can’t write a data set for local knowledge. That’s why we want to work with firms and empower them to do their job better, rather than attempt to find a new way of doing what they do using technology.

It seems like integration with proptech, rather than full-scale disruption is going to be the path for the property industry.

Yes, for the short term certainly. In the longer term, I think the web will get everywhere and new opportunities will arise built on the changing behaviour patterns the first wave of innovation creates. I don’t think that the industry can ignore the proptech movement. Forward thinking firms should take advantage of new technology and get in the mindset of early adoption – try lots of new things, discard when they don’t work or there is a new system to gain an advantage from, in the same way consumers do. I can’t predict what’s going to happen, but I do think it’s an interesting area. Having said that, clearly the whole planning system could be reconfigured and make huge efficiencies for the market.

Back to Land Insight in particular – what’s feedback been like so far? And what have been the big learnings?

Well, when we first opened up beta there were a lot of companies that jumped on board. We started getting all this feedback coming in from all angles – people seeing the potential of the product and pointing us in the direction of all these different unrelated opportunities. This was a really interesting time because having all these options forced us to find ways to filter through them. We did this by working out what we are as a company and what we wanted to achieve, which was really important.

Following the lean start-up method of releasing updates early and getting all this feedback has been really helpful too, because now we know that property developers and agents are finding the best value from the product – they use the data the most and can save the most time and money. But it also helped us to learn that if we add a few features down the line we can also open to other sections of the market. Architects for example, will really benefit from one or two of our developments.

What are the data sets that are most valuable to people?

Planning applications and land ownership data – we provide free access to a non-private ownership and the way that we can do things with that data is completely new, we can innovate on top of that.

At different times variables like height data – how high surrounding property is – have proved really useful as well.

What other data sets are you planning to bring in?

We’ve had people ask us for a few different sets and we do have plans to add more, but currently we’re more interested in how we can extract the best value from the data sets we’ve already spent huge resources in amassing and believe have massive value through data visualisation, cross referencing and ensuring everyone has the most readily available version of the parameters that most interests their model.

Will you expand into other countries? Europe or even The States?

That’s a really interesting question. We’re very focused on the UK at the moment and a lot of our stuff is about quality of data. So if a country has good mapping or land registry potentially we could go there. But the way I see it, we’ve developed some interesting technology around geography and time and space and that’s more scalable than us doing the work of the getting the data. So potentially we could expand into other countries but for the moment we’re very focused on here.

One review on Land Insight I read said that ‘every person in the property industry will have to build their databases, products and dashboards on top of [your] tech’. Is that true?

Hmmm… that’s a nice prediction. We do find that with the larger companies we work with they usually want an integration piece, as they have years of intelligence built up.

Sorry, tough question! The suffix to that one is where do you see Land Insight going in the next few years?

We’re very mission driven. We started the company because we saw problems with finding land. We’ll know we’ve achieved our goals if we can see that we’ve made a real contribution to more people finding sites to build on. That’ll be one of our KPIs. But it’s not a social project – our view is that if we create value for the world we’ll create a valuable company and we intend to keep on attracting the investment we need to make a real impact. We’ve seen so many opportunities for other people to use our data – from retail to industrial sectors. But that’s kind of obvious stuff – there are a lot of interesting opportunities we can see too.

Are you able to elaborate on this…?

We want data not to be a commodity but a starting point. So it’s not like you go to some platforms where you use a map and then buy some data – we give you everything and then it’s about what it can do for you. We want to get ourselves away from saying this is the use of the product and get to a point where users can ask a range of questions and find what they need. That’s more how I see us developing.

What kind of questions?

Say, if you want to find a low density site capable of 1-20 homes in North Hackney then it’s easy to find a bunch of sites. Or if you want to find all planning applications for student accommodation in every major city in the UK in the last 5 years that are close to a supermarket. That would be another question. This is already close within but the finesse and accuracy is improving all the time.

And finally, what message would you like to send out to any interested people reading this?

A lot of people think we’re still in BETA but we’re out there now and have happy customers. And that it so happens we’ve got a special offer on at the moment – haha!

What’s the best way to keep up with your news?

Follow us on Twitter – @getlandinsight. On our website – LandInsight.io we’ve got a signup form that people can access to get our newsletter. We’ve got a blog as well which we put all our latest news on.